Performance

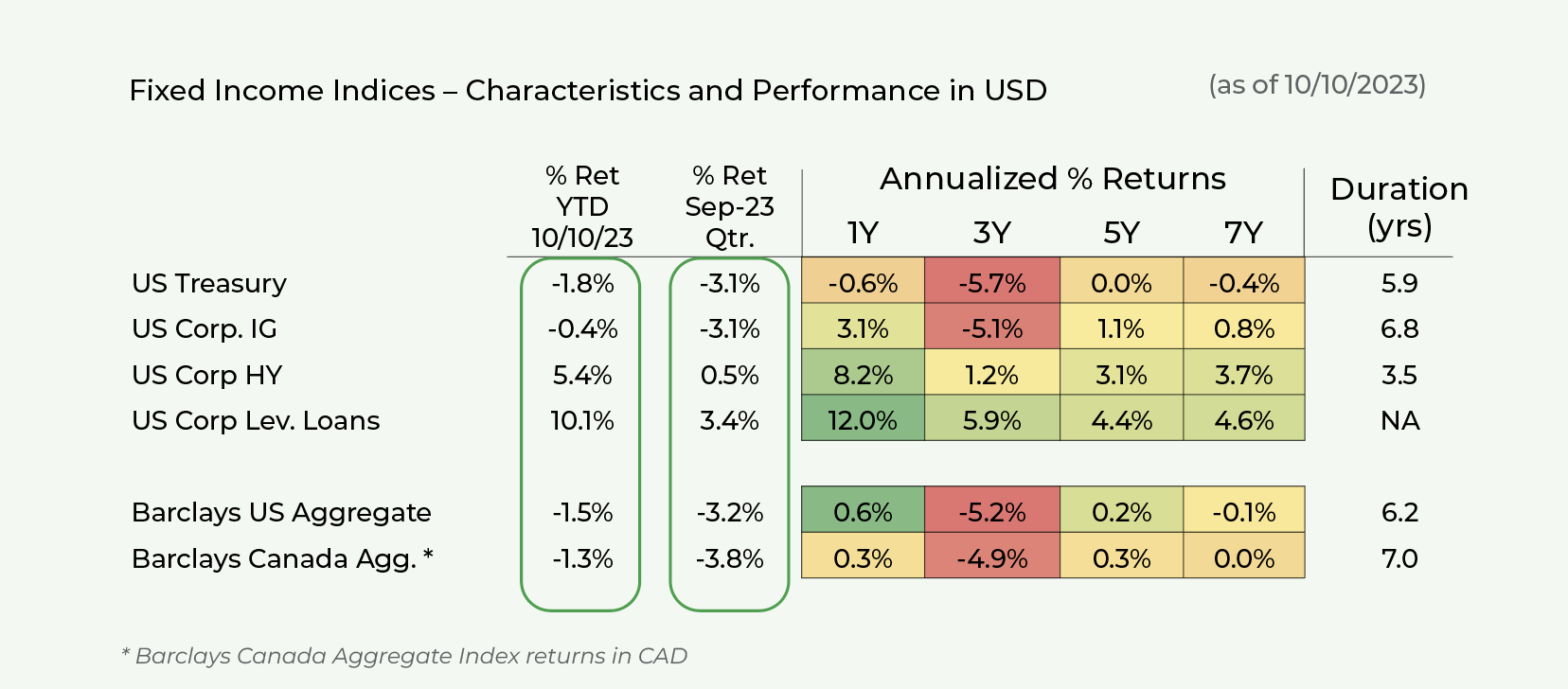

Safe fixed income (government bonds and corporate investment grade bonds) declined significantly during Q3 as interest rates sharply increased.

Yields rose across the US Treasury yield curve, with the curve becoming less inverted during the quarter. Yields on shorter-term bonds (2-to-3-year maturities) stayed rose 15bps to 30bps while yields on longer-term bonds (10-to-30-year maturities) rose by 70bps to 85bps.

This occurred as the probability of achieving a soft landing continued to rise. Core inflation data has continued to moderate while employment data, consumer spending, and several other economic metrics remain strong.

Both high yield bonds and leveraged loans have appreciated YTD.

HY bonds have primarily benefitted from high coupon rates coupled with spread tightening. These positive factors have been offset by increases in Treasury base rates.

CCC-rated (the riskiest) high-yield bonds have performed best thus far this year (+12.0%) despite bankruptcy filings reaching the highest levels since the GFC.

Leveraged loans have benefitted from high coupon rates (driven by increases in the SOFR base rate) and from spread tightening.

Valuation

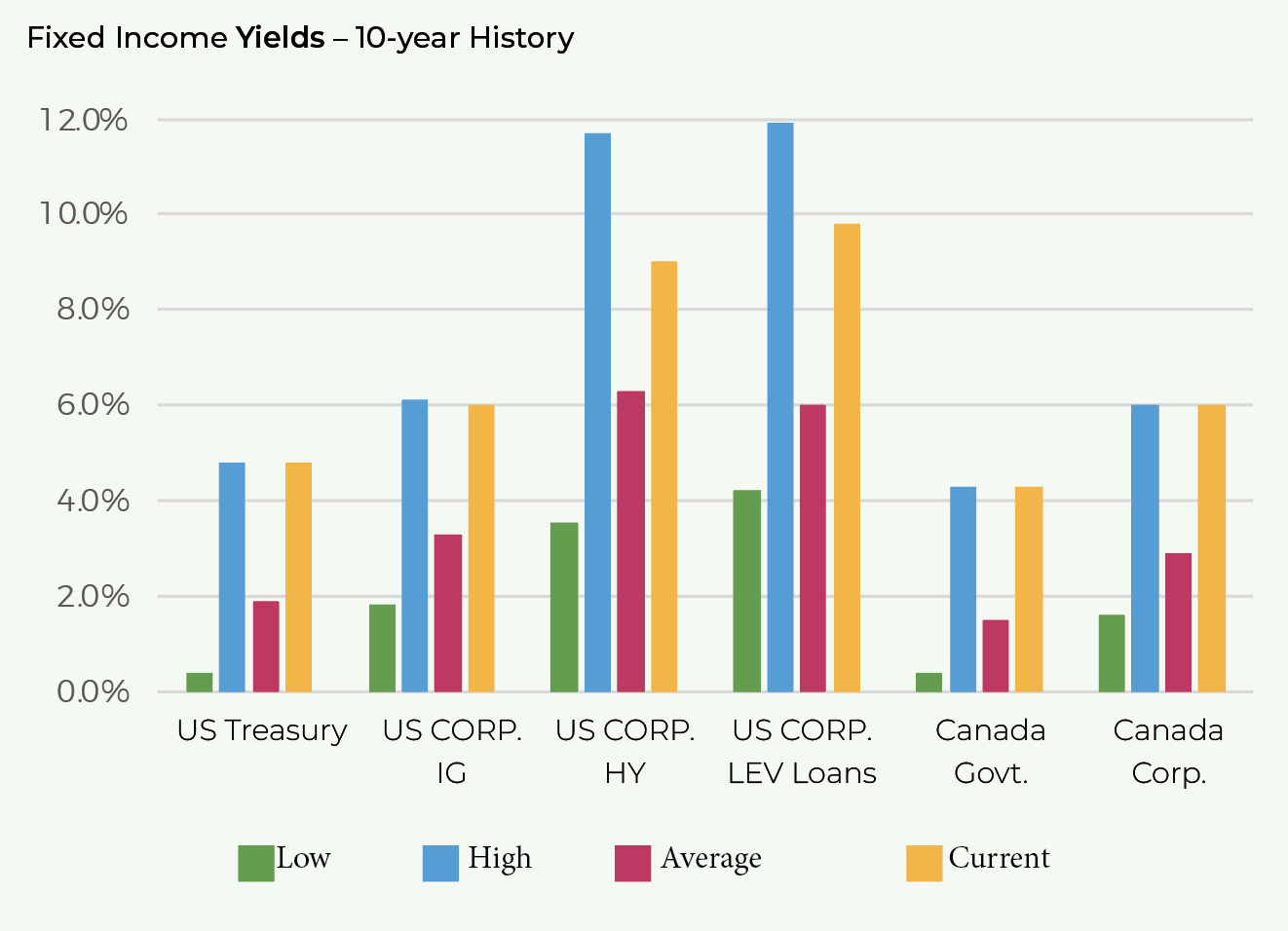

Safe fixed income (government bonds and investment grade corporate bonds) yields remain at highly attractive levels.

US Treasuries are yielding roughly 4.9%-5.5% for 1-to-2-year maturities and 4.6% for 10-year maturities.

US corporate investment grade bonds are now yielding 6.0% (with risk of default very low).

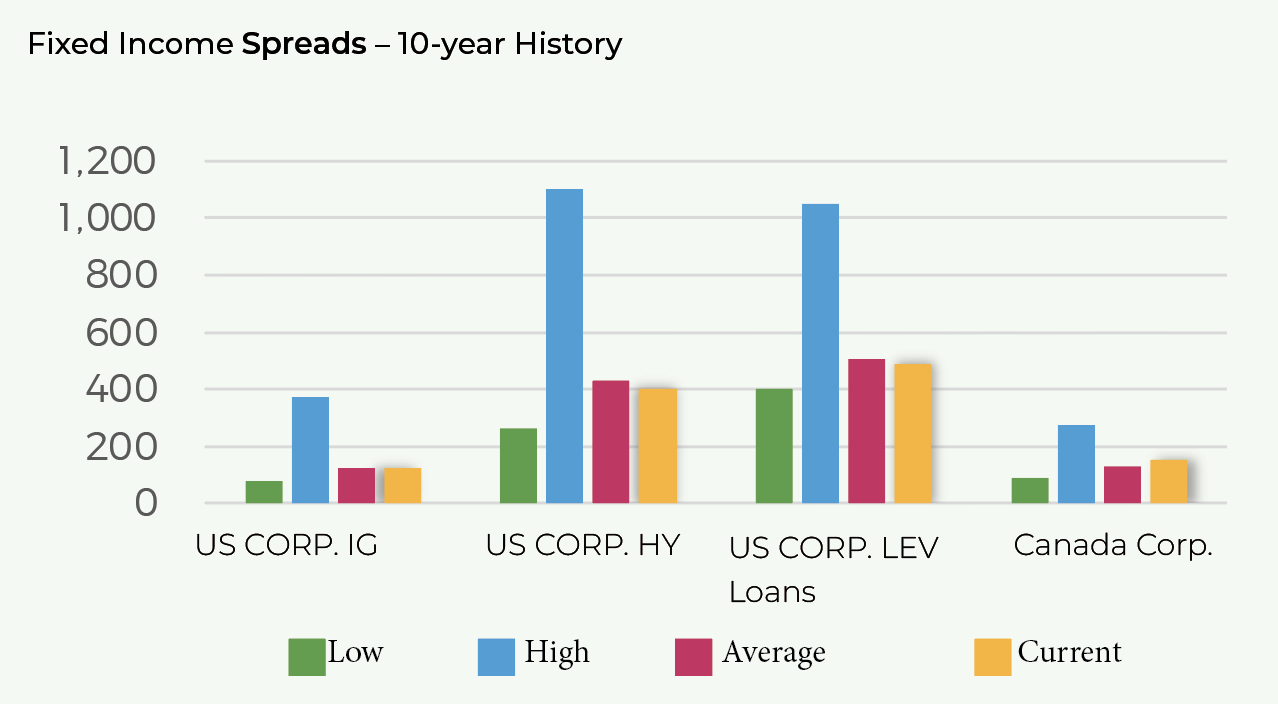

Investment grade corporate bond spreads have modestly declined YTD while high yield bond spreads have tightened more significantly.

IG spreads are presently at 125bps (vs. 141bps at YE 2022) and HY spreads are at 403bps (vs. 469bps at YE 2022).

Spreads have generally widened further during prior recessionary periods (200bps for corporate bonds and 800bps for HY bonds).

However, the quality of the high yield index is much stronger now than in previous periods. When coupled with today’s high base rates, it is unlikely that spreads will widen to those experienced in previous recessions (even if economic activity slows substantially).

Signs of credit stress are increasingly emerging with default rates rising (off very low base levels) and corporate bankruptcy filings reaching levels not seen since the GFC.

S&P expects defaults rates to increase to 4.5% by June 2024 versus 3.2% in June 2023.