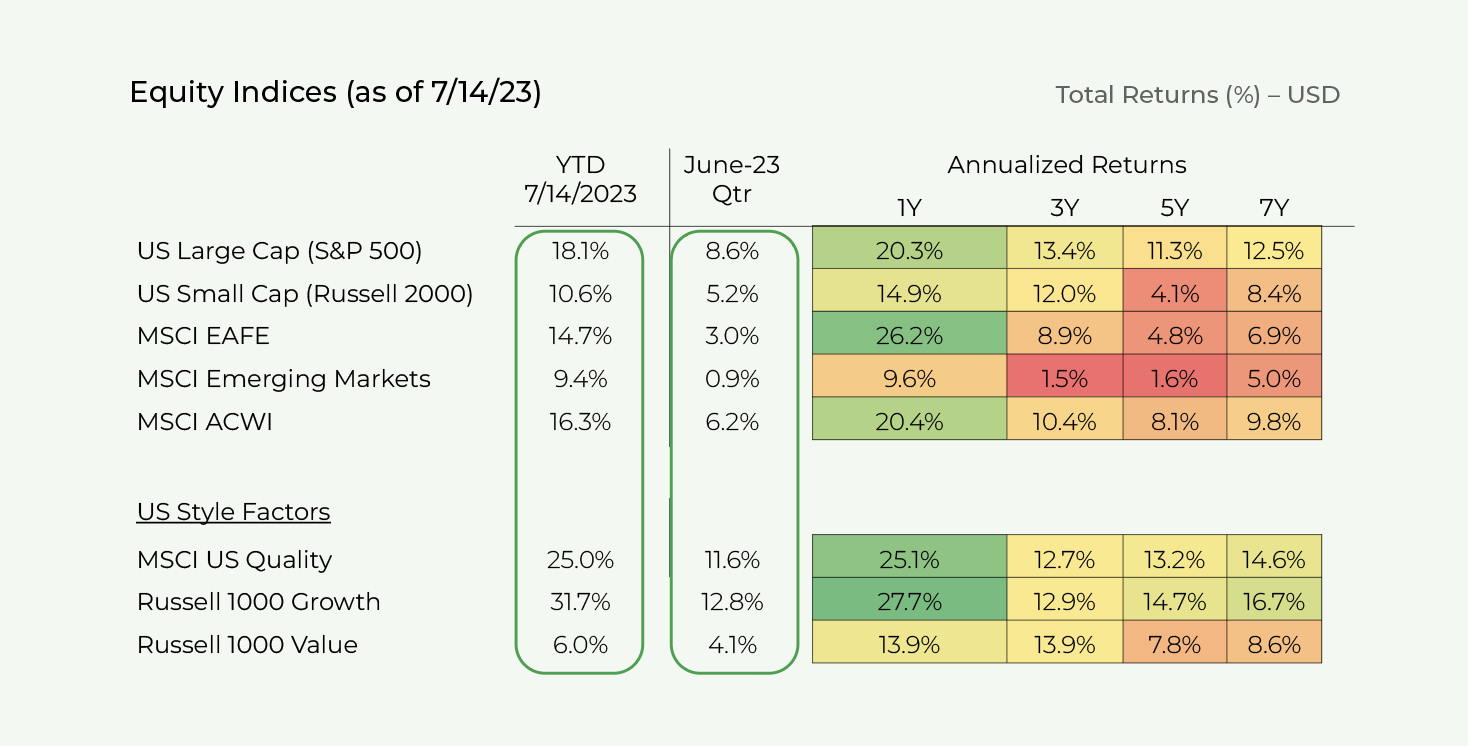

Performance

Equity markets (MSCI ACWI Index) appreciated by 6.2% during Q2 with YTD gains of 16.3% through July 14th.

During Q2, US stocks (+8.6%) materially outperformed international developed stocks (+3.0%) and emerging markets stocks (+0.9%).

Globally, growth stocks (+9.2%) materially outperformed value stocks (+3.0%) during Q2. YTD, growth stocks are up 27.3% while value stocks are only up 5.9%.

Technology (+13.7%) and consumer discretionary stocks (+8.2%) outperformed meaningfully during Q2 and YTD.

Defensive sectors such as utilities, consumer staples and healthcare continued their underperformance during Q2 (-0.1% to +2.3%) and YTD (flat to +4.7%).

Cyclical sectors posted mixed performance during Q2 with financials and industrial sectors performing relatively well (+5.2% and +6.3%) while materials and energy sectors faltered (-0.8% and +0.8%).

US large-cap equities (S&P 500) were up 8.6% during Q2 and 18.1% YTD.

Large-cap technology, internet, and certain consumer discretionary (Tesla) stocks continued to outperform during Q2. These sectors benefitted from investors heightened focus on perceived beneficiaries of AI trends coupled with better than anticipated Q1 earnings and rest of the year guidance.

The Nasdaq and Russell 1000 Growth Index are up 43.0% and 31.7% YTD. Several mega cap tech names that are perceived beneficiaries from AI are up over 50% with Nvidia up 212%.

Nvidia shocked the market on April 25th with a strong earnings forecast and an unprecedented guidance raise (the company increased it’s Q2 revenue guidance from $7bln to $11bln driven by strong spending for its AI-oriented semiconductors). Since that date, both the broader technology sector (+17.9%) and the semiconductor sub-sector have appreciated substantially (+30.2%).

AI appears to have immense potential as the next technological revolution. The use of generative AI is increasing quickly, and its effects on growth and productivity may occur much faster relative to previous technological revolutions such as the internet.

In an upside case scenario, Goldman Sachs forecasted that AI could lift labor productivity growth by 1.5% over the next decade and boost corporate profit margins by 400bps over that time frame.

Likely beneficiaries include specialized chipmakers, cloud storage providers, as well as software tools developers.

Nevertheless, identifying winners and losers from AI is far from clear cut and the ultimate effect on corporate earnings (both across the technology sector and more broadly across the market) is highly uncertain.

Encouragingly, the US stock rally has broadened to other sectors and even to smaller capitalization stocks since the end of May.

The equal-weighted S&P 500 and Russell 2000 Small-Cap indexes were up 4.0% and 5.2% during Q2 vs. 8.6% for the S&P 500 market-cap weighted index. YTD, the equal-weighted and small-cap indexes are up 8.7% and 10.6% respectively, with most of those gains occurring during June and July.

The broadening of the rally to other sectors outside of technology was driven by abating recessionary fears as economic data surprised to the upside and inflation declined faster than expected in June.

International developed stocks (MSCI EAFE) were up 3.0% during Q2 and 14.7% YTD.

The rally in European stocks stalled modestly during the quarter with European equities up 2.8% in USD.

On the one hand, Q1 earnings came in better than expected. However, economic conditions began to slow during Q2 and China’s post-COVID recovery (Europe is a large exporter to China) slowed sharply as well.

Japanese equities appreciated by 6.4% in USD and 15.7% in local currency. Japanese equities benefitted from a combination of equity buying by pension plans and the central bank, increasing focus on corporate profit improvement, continued weakness in the Yen vs. other major currencies, and maintenance of ultra-loose monetary policy (super low interest rates) despite rising inflation.

Emerging markets were up 0.9% during Q2 and 8.5% YTD.

Chinese equities were down 9.8% during

the quarter and retraced much of Q1 gains.

The underperformance was driven by a sharp slowdown in China’s nascent post-COVID recovery coupled with continued concerns regarding the country’s embattled property development sector.

We anticipate that China will increase its stimulus efforts over H2 2023, which could provide uplift to Chinese equities and emerging markets broadly. However, these efforts will likely be piecemeal and not the large infrastructure driven stimulus seen post GFC and during 2016.

In the US and to a large extent international developed markets, Q1 corporate earnings came in far better than expected (S&P 500 earnings declined -2.8% YOY vs. -8.0% expectation). Q2 earnings season is set to begin in earnest over the next few weeks.

Analysts are forecasting a 7.1% YOY earnings decline in Q2 for the S&P 500 (although actual earnings are likely to surprise to the upside which is typically the norm just prior to earnings season).

Confidence with regards to achieving a soft-landing scenario (mild to no earnings decline in 2023 followed by growth in 2024) is increasing. However, several risks factors to corporate earnings remain including a) uncertainty regarding the ultimate lagged effect of cumulative interest rate hikes on US and European economies, b) ability of US consumers to maintain high levels of spending, c) potential for core inflation to remain higher for longer leading to higher peak interest rates and d) geopolitical tensions. As such, major uncertainty remains with regards to H2 2023 and especially 2024 earnings.

On the one hand, the consumer remains strong (especially in the US). Therefore, companies have been able to hold or raise price and thus largely protect or even increase margins in many cases (especially as input costs are moderating). However, it is unclear when consumers’ excess pandemic savings will be depleted and whether they will pull back on record-high credit-card borrowings.

On the other hand, enterprise spending has been cautious. Furthermore, monetary policy works with long lags (typically 12-18 months) and several economists believe that a mild earnings recession (7%-15% earnings decline) has merely been postponed rather than avoided.

For investors with a mid-term time frame, we continue to believe that stocks of high-quality companies will outperform given their strong business models, superior revenue and earnings growth and strong returns on capital.

However, given the massive YTD outperformance of growth stocks (especially technology stocks that have benefitted from AI sentiment), we would not be surprised to see value stocks outperform over the next 6-9 months.

The NASDAQ 100 and Russell 1000 Growth indexes are up 43.0% and 31.7% YTD.

Valuations have now climbed relatively close to pandemic-era highs and well above historical norms. Growth stocks may be susceptible to a 10%-20% pullback should earnings results and forecasts disappoint lofty AI-driven expectations.

Certain value stocks such as financials and energy have performed poorly YTD and valuations appear attractive. Bank stocks have already rebounded 10%-20% following Q2 earnings as fundamentals appear to have stabilized, earnings were better than feared, and valuations were extremely cheap relative to history.

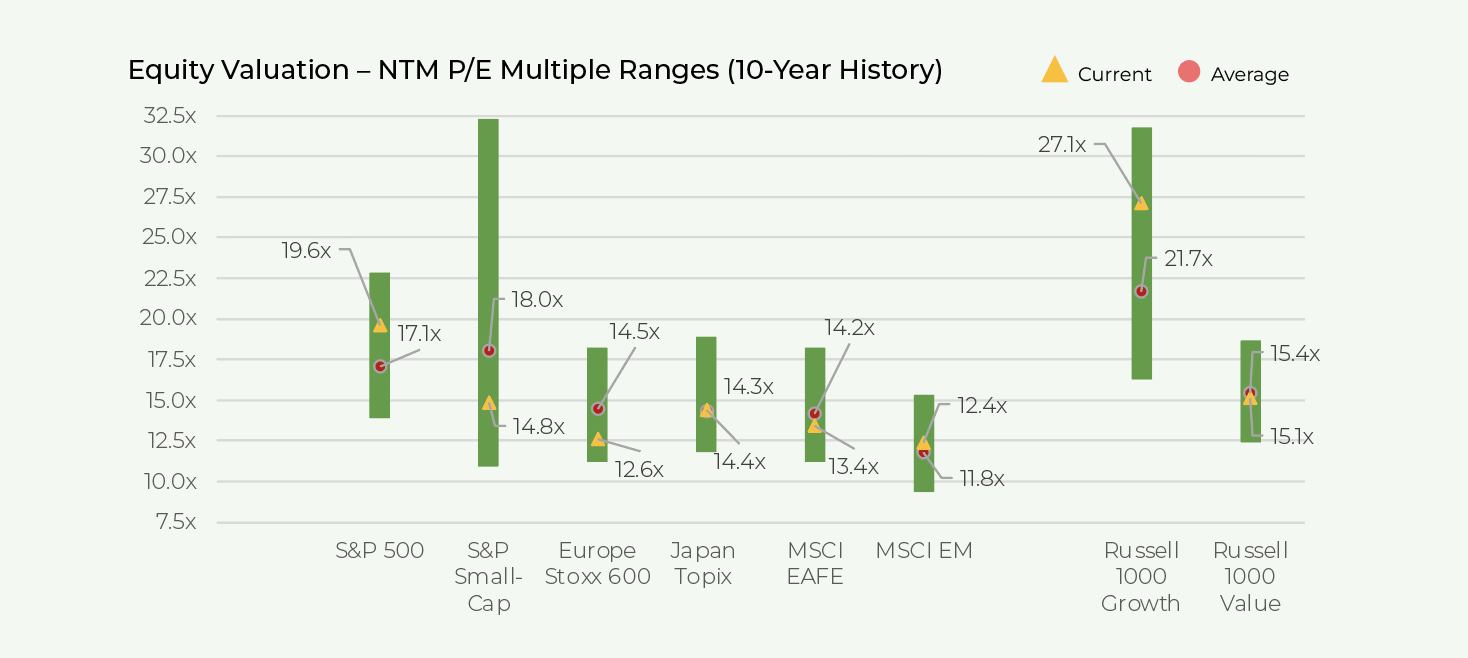

Valuation

Equity markets are generally fairly valued to modestly overvalued relative to historical averages.

The S&P 500’s forward P/E multiple has risen sharply to 19.6x from 17.0x at the beginning of the year (and well above its 10-year and longer-term averages of 17.1x and 16.5x respectively).

International developed markets are trading at 13.4x forward earnings (roughly 7% below historical averages) while emerging markets are trading at 12.4x forward earnings (roughly 5% above historical averages).

In the US, equity market valuations are expensive relative to government bonds.

The S&P 500 presently trades at 19.6x consensus NTM earnings (which may be too high)

Historically, the S&P 500 earnings yield (inverse of multiple) has averaged 200-300bps over 10-Year Treasuries.

With 10-year Treasuries yielding 3.8%, a 15x-17x forward EPS multiple is “fair” for the S&P 500.

Additionally, our mid-term return outlook for risky corporate credit (high yield bonds and leveraged loans) is similar to that for equities, with lower risk.