We consider the following factors when developing our 7-year forecasts.

Interest rates are likely to decline from current levels but will not return to the ultra-low-levels experienced between 2009-2021.

Corporate profit margins will be influenced by two opposing factors. On the one hand, onshoring and less labor flexibility may dampen margins. On the other hand, AI adoption may increase productivity and expand margins (especially in the US).

Geopolitical uncertainty is increasing regarding the US-China relationship and potential for other episodic military conflicts.

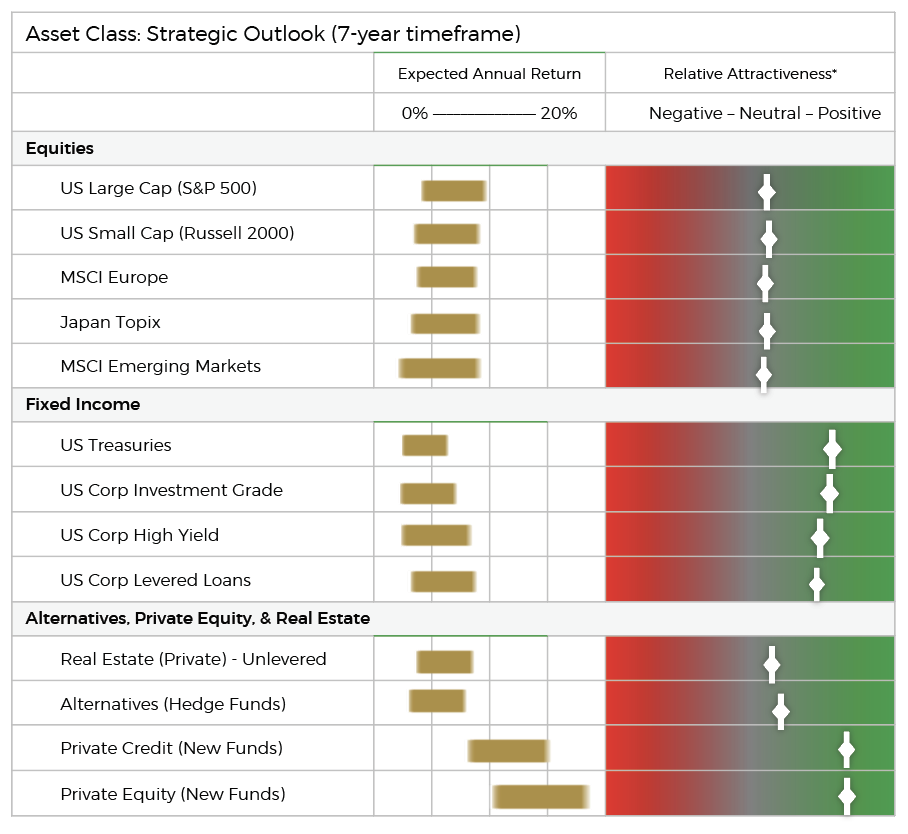

With equity valuations having materially increased over the past 18 months, we now expect mid-single digit nominal pre-tax annual equity returns (6.0%-7.0%) over a seven-year forecast period.

While we expect US stocks to outperform international markets, we anticipate greater convergence between US and International equity market returns given highly elevated US valuations.

In addition, while we expect quality and growth stocks to outperform value stocks over the next seven years, the rate of outperformance is likely to be lower than that over the past seven years.

US equity market valuations are stretched while international equity market valuations are generally in-line with historical averages. Thus, earnings growth and dividends, rather than multiple expansion, are likely to drive returns.

Potential wildcards (especially for tech-oriented US markets) include the pace of adoption of generative AI and the resulting potential for above-trend revenue growth and margin expansion.

“Safe” fixed income remains attractive on a relative basis.

Base yields across the curve are greater than 4.0% for maturities ranging between 2 and 10 years.

US 10-Year Treasuries are yielding 4.18% (up from 3.87% at YE 2023 but down from 4.7% at the end of April). We expect that the 10-year will trade within a 3.75% to 4.75% range over the near-term, although we believe that the lower-end of the range is more likely to be breached vs. the upper end.

We expect mid-single digit returns for US government debt and investment grade bonds over the forecast period.

On a risk-adjusted pre-tax basis, safe fixed income’s return potential is attractive relative to equities.

Riskier credit assets (high-yield bonds and leveraged loans) are also attractive over a mid-term time frame.

US high-yield bonds are now yielding 7.8% while leveraged loans are currently yielding 9.3%. Expected returns for both assets classes are roughly 6.5%.

High base yields provide attractive total current yield for both asset classes.

However, high yield spreads of 310bps are below historical averages and are well below those seen during recessions (600bps-800bps). Should a recession occur, these spreads will likely widen and negatively affect near-term price returns (although total returns should remain cushioned by high starting yields).

On a relative basis, riskier credit is less attractive vs. safe government bonds based on lower spreads. However, relative to equities, riskier credit remains attractive on a pre-tax basis.

For new private market strategies (i.e., private equity and private credit,) we continue to forecast higher returns relative to public markets (over a multi-year timeframe).

* The attractiveness of each asset class (as depicted by the positioning of the sliders) is based upon risk-adjusted returns when considering expected returns, volatility, and liquidity. Thus, US Treasuries with mid-single digit returns are shown as highly attractive given a low-risk profile whereas public equities are only rated modestly attractive despite their higher expected return as equities have much greater volatility.