Performance

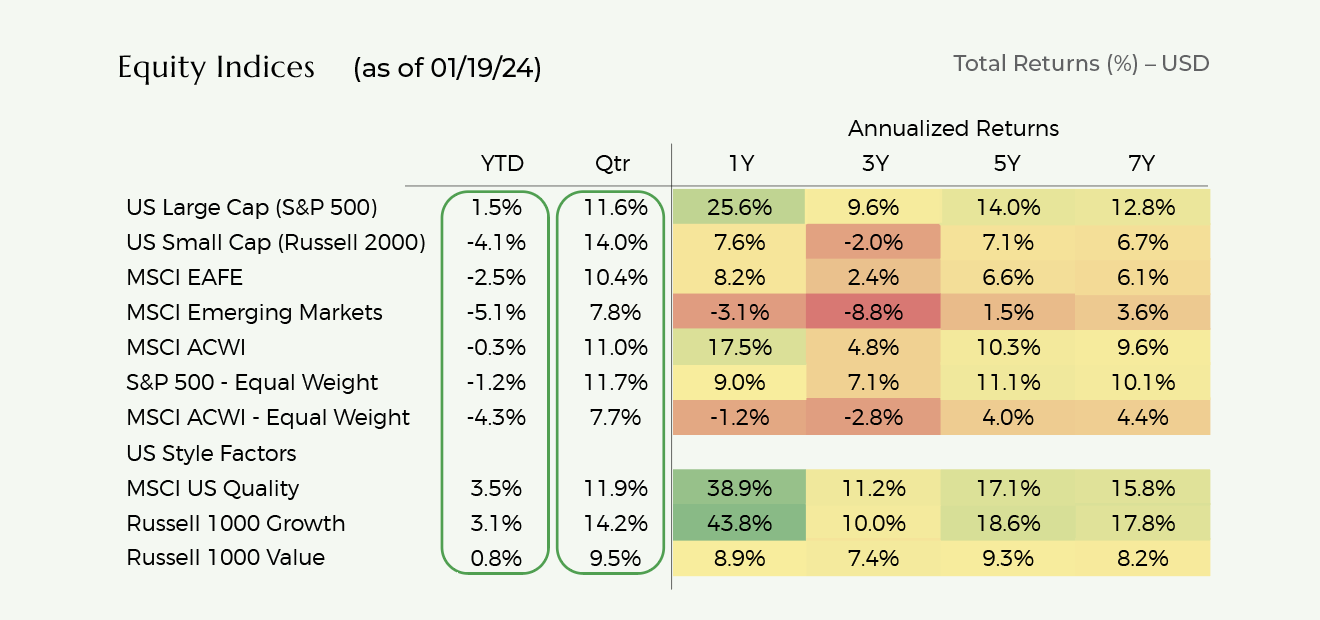

Global equity markets (MSCI ACWI Index) increased by 11.0% during Q4 and 22.4% during 2023.

During Q4, all major geographic regions experienced material appreciation ranging from 7.9% to 11.5%.

Globally, growth stocks (+12.7%) continued to outperform value stocks (+9.1%) during Q4. Over full year 2023, growth stock outperformance was even more stark (+33.2% versus +11.8%).

However, this growth versus value outperformance was largely driven by US growth stocks (+42.7% versus +11.5% for 2023). International developed growth stocks modestly underperformed value stocks (+17.6% versus +19.0%) and emerging markets growth stocks materially underperformed value stocks (+5.8% versus +14.2%).

During Q4, technology (+17.6%), industrials (+13.2%) and financials (+12.5%) performed best while energy performed worst (-2.5%).

For full year 2023, technology and communication services (especially internet-oriented companies) dominated with +51.8% and +37.,7% performance. Several of the Magnificent Seven stocks were up 50%-200%.

Perceived defensive stocks such as healthcare and consumer staples performed poorly with +3.5% and +2.5% gains over full year 2023.

US large-cap equities (S&P 500) were up 11.6% during Q4 and +25.7% for full year 2023.

The YTD performance is deceptive however and has been driven by a select group of technology, consumer discretionary, and internet stocks (the Magnificent Seven comprised of Nvidia, Apple, Microsoft, Alphabet, Meta, Amazon and Tesla).

On an equally weighted basis (as opposed to market-cap weighted), the S&P 500 was only up for full year 2023.

These seven stocks now comprise 29.6% of the market cap of the S&P 500 (eclipsing the 29.1% peak seen in 2021).

In Q4, most sectors performed well with technology leading (+17.2%) and energy lagging (-6.7%).

On a full year 2023 basis, US technology and communication services sectors performed best (+57.9% and +55.8%) while energy (-1.5%) and defensive sectors such as healthcare(+2.1%) and consumer staples (+0.5%) performed worst.

US small cap stocks rallied by 14.0% during Q4 which brought 2023 gains to +16.9%.

Small caps are perceived to strongly benefit from lower interest rates as they tend to be more highly levered.

International developed stocks (MSCI EAFE) were up 10.4% during Q4 and up 18.2% during 2023 in USD.

During 2023, European stocks appreciated by 19.5% in USD as corporate profits remained high despite weak European macro fundamentals. Japanese equities appreciated by 20.6% in USD terms as companies benefitted from the weaker yen and demonstrated improved shareholder governance practices.

Emerging markets were up 7.9% during Q4 and +9.8% for full year 2023 in USD.

During 2023, EM performance has essentially consisted of divergent China and non-China stories. Chinese equities (now comprise 27% of the index) were down 11.2% in USD while most other EM countries such as India, Taiwan, Korea, Brazil and Mexico delivered very strong returns (ranging between 21% to 33%).

Chinese equities were down 4.8% during the quarter and were down 11.2% over 2023.

The underperformance was driven by a sharp slowdown in China’s nascent post-COVID recovery coupled with continued concerns regarding the country’s embattled property development sector.

Thus far, government fiscal and monetary stimulus has been relatively muted. The government will need to embark on much more aggressive stimulus for economic growth to accelerate and reach targeted 5% GDP growth levels in 2024 and beyond.

For investors with a mid-term time frame, we continue to believe that stocks of high-quality companies will outperform given their strong business models, superior revenue and earnings growth and strong returns on capital.

However, many of these quality growth stocks (especially technology stocks that have benefitted from AI spending and sentiment) appreciated massively in 2023 and in some cases, their valuations have become more expensive.

The NASDAQ 100 and Russell 1000 Growth indexes appreciated 55.1% and 42.7% in 2023. Valuations have increased and are well above historical norms (although lower than peaks seen at year-end 2021).

Operating fundamentals appear strong for many of these companies with healthy demand and restrained costs. However, as valuations have surged, these companies will likely need to beat earnings expectations to deliver double-digit stock price performance in 2024.

Certain value stocks such as healthcare and financials underperformed on a relative basis in 2023, and relative valuations appear attractive.

Bank stocks may rebound if loss provisions remain relatively low and CEO commentary regarding the macro economy becomes more bullish if the soft-landing scenario takes hold. Healthcare stocks may rally as the cost surge associated with increased post-pandemic utilization normalizes and as abnormally high COVID-related revenues / earnings (achieved in 2021 and 2022) no longer affect comparisons as they have settled at lower sustainable levels in 2023.

Valuation

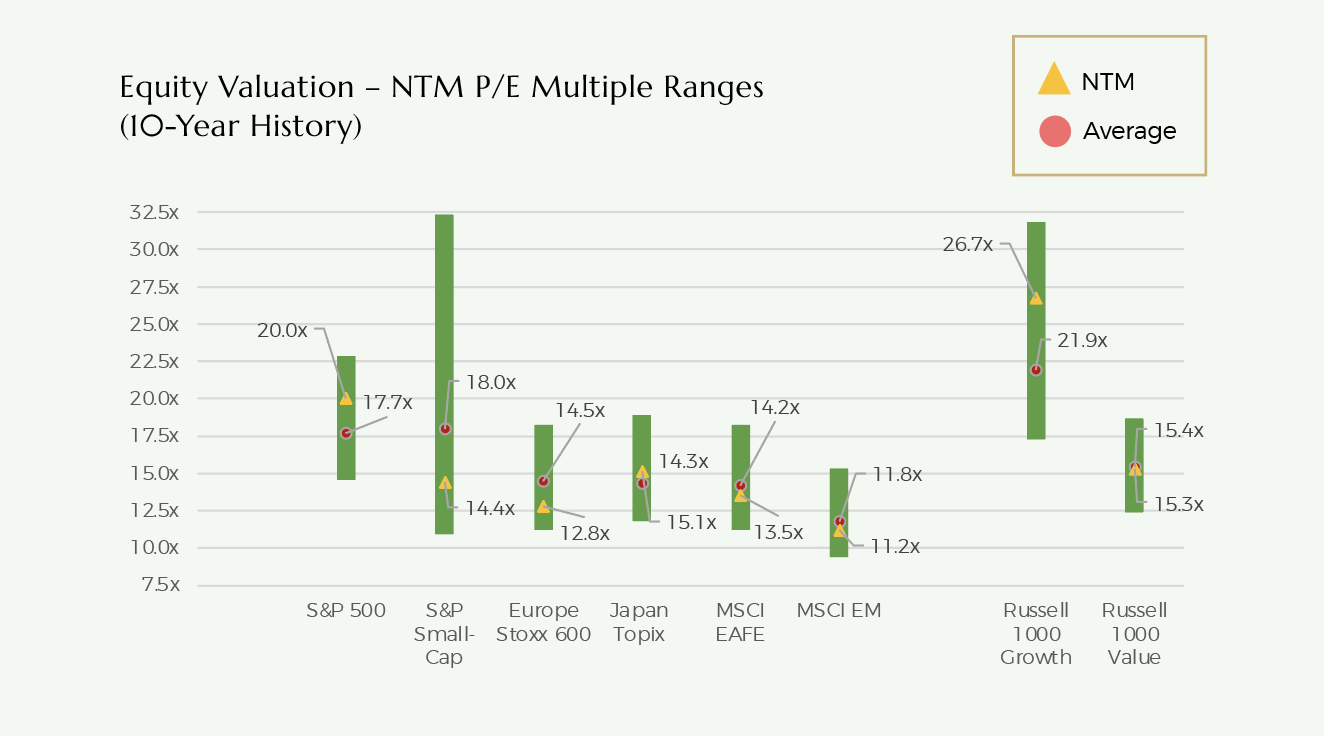

Equity markets are generally fairly valued relative to historical averages with US markets modestly overvalued and international developed markets fairly valued-to-modestly undervalued.

The S&P 500’s valuation is nuanced however. While the market-cap weighted S&P 500 Index trades at 20.0x NTM P/E, the equal-weighted S&P 500 trades at 16.5x NTM P/E (inline with historical averages).

The “Magnificent Seven” now comprise 29% of the S&P 500 Index market capitalization. These stocks trade at 34.0x NTM P/E, certainly ahead of their pre-pandemic valuations but not egregiously so. The companies continue to demand a significant premium to the average S&P 500 stock given their superior business models, faster revenue and earnings growth profiles, and dominant leadership positions in secularly attractive end markets.

Hence, while the S&P 500’s valuation may look expensive relative to history, this increase seems largely due to the changing composition of the index and its shift towards much higher quality companies that have exhibited staying power while delivering attractive earnings growth.

In the US, equity market valuations are expensive relative to government bonds.

The S&P 500 presently trades at 20.0x consensus NTM earnings (which may be too high).

Historically, the S&P 500 earnings yield (inverse of multiple) has averaged 200-300bps over 10-Year Treasuries.

With 10-year Treasuries yielding 4.1%, at first glance, a 14.0x-16.5x forward EPS multiple is “fair” for the S&P 500 based on relative valuations to bonds.

However, most investors do not expect the 10-year Treasury to remain at 4.1% for an extended period of a time. If the 10-year was to retreat to 3.5%, a fair valuation of 15.5x-18.0x forward EPS is more reasonable (based on historical relationships).