Ultra-High-Net-Worth Investors: Preparing for What's Ahead

Consider the future and how to make your wealth work on your behalf

Strategic Planning

Strategic Planning

Family Office

Ultra-High-Net-Worth Investors: Preparing for What's Ahead

Consider the future and how to make your wealth work on your behalf

Strategic Planning

Strategic Planning

Family Office

Family OFFICE

How to Create, Organize and Coordinate the Ecosystem

Family OFFICE

How to Create, Organize and Coordinate the Ecosystem

A Family Office is a network of resources and activities that serve wealthy individuals or families. These networks can take many forms to serve various family needs and priorities. As is often the case, one size or shape does not fit all.

The following describes several key functions of F.O.s, how they may be effectively organized, and which aspects are best suited to highly qualified third-party providers and which to dedicated (“in-house”) staff. It also addresses the critical consideration of directing and coordinating a family office network.

Needs & Services

It is helpful to group frequently needed activities and services into four areas:

General Professional Services

Estate planning, entity structuring/governance, tax planning, tax preparation

Investment-Related Activities

Goal-setting, planning and strategic asset allocation, investment selection/ monitoring/reporting, direct investing and business support

Administrative Services

Accounting/bookkeeping, financial reporting, custodial accounts/treasury and bill-paying

Family Services

Residence/transportation management, concierge services, gifting/philanthropy/foundation

We think of the Family Office as the group of people working together to meet these needs. This can include professionals working at various firms engaged by the principals, people employed directly by the principals, or any mix of the two.

Infrastructure: Various Approaches are Possible

Your family’s level of wealth is crucial when weighing benefits and costs to determine the most effective approach to developing a F.O. solution. This influences types of needs that may be relevant and whether those needs are best met by internal or external resources. As mentioned, by “external” we mean engaging a third-party firm/professional on an outsourced basis (ongoing or project-based), and by “internal” we mean a direct “inhouse” hire (in a full or part-time role). Externally provided resources tend to be variable costs, while the cost of internal resources are often fixed.

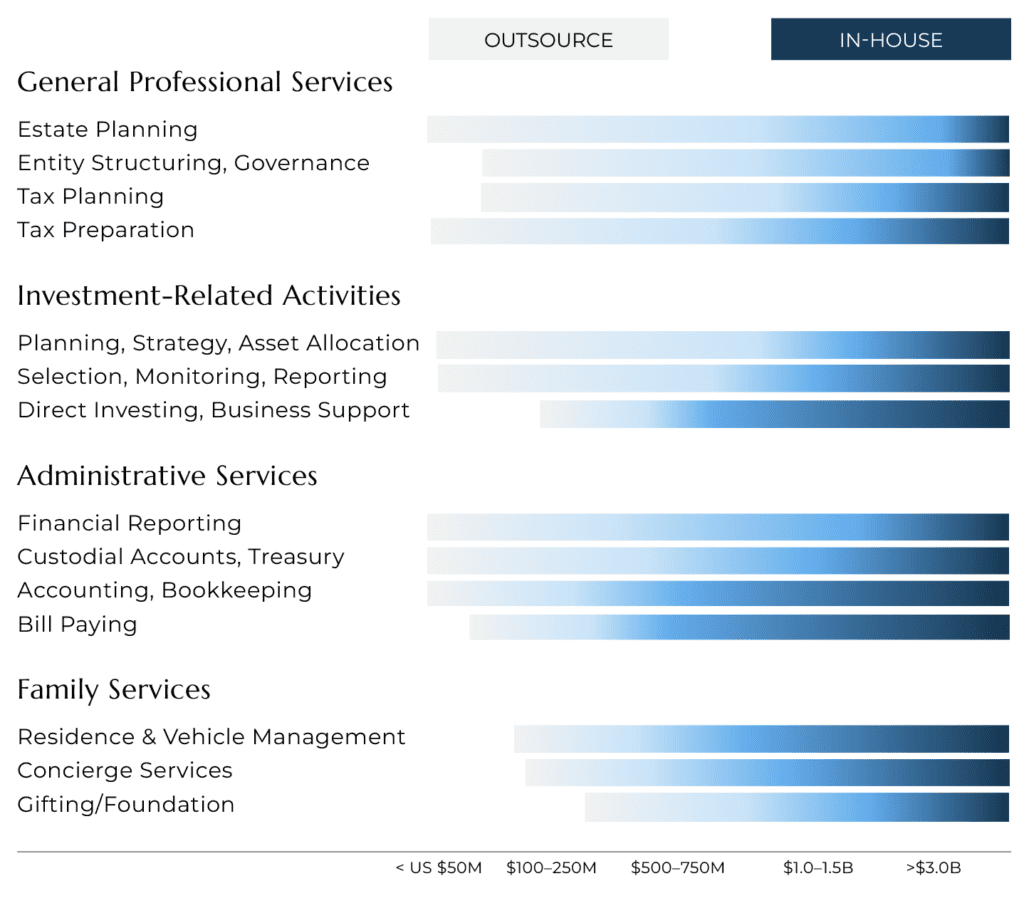

In our experience, the graphic on the next page represents general levels of wealth at which these various activities may become relevant and whether they may be best served by external or internal resources – or a mix of the two.

Evolution of Family Office Capabilities

General Professional Services

Fortunately, the activities that are more one-time or episodic are also those that require the most specialized expertise. As a result, in the General Services category, engaging third-party expert professionals is usually the most effective route for almost any level of wealth.

Such expert professionals include (but are not limited to):

- Trust & estate attorneys

- Tax attorneys

- Tax accountants and preparers

The frequency, complexity, specialization and responsiveness required (such as tax advice for cross-border investments or estate planning) may influence your decision on specific arrangements to engage the services of these professionals.

If you decide to use trust structures as part of your plan, there are many choices of trust types and related roles to be filled. These may range from using corporate trustees for more traditional services to individual trustees for what are sometimes more bespoke private trusts where more boutique trust companies provide administrative services.

Investment-Related Activities

The design and oversight of investment portfolios is a core need of family offices (and one of BCA’s core competencies). Investment design, strategy, oversight and implementation should be a broad-scope and dynamic activity to:

Define investment goals and policies to reflect your personal objectives

Allocate assets (i.e., what types and in what proportion), considering capital available and evolving market conditions

Execute the plan

Identify, evaluate, select and monitor a diversified collection of investment managers. We believe the management of specific investment strategies should be outsourced to specialty portfolio managers (both active and passive), each of which focuses on its particular expertise. The F.O. should have a comprehensive top-down plan to guide and evaluate this essential activity.

Report

Providing an integrated picture of exposures and performance of the entire, holistic portfolio, regardless of the source or management responsibility for each investment.

Only the very largest family offices – with more than $2 billion or so of investible assets in our estimation – may have sufficient scale to consider hiring an internal team of portfolio managers and related staff to both shape asset allocation and directly invest a significant portion of capital (and even then, should outsource many specialized investment strategies).

So principals are most often best served by using an investment advisor to design, execute and oversee a strategy using third-party managers. In our view, they should engage investment advisory services from independent firms without any commercial ties to portfolio managers (or their parent companies) or distributors selling those products. This separation creates inherent checks-and-balances and the best economic alignment between you and your advisor (while avoiding an advisor that is both referee and player).

Custodial relationships round out the investment infrastructure needs. They provide the vital functions of holding assets, executing trades and transferring funds. Our clients typically receive such services simply by opening accounts at bank subsidiaries and independent brokerage firms. For reasons like those discussed above, we generally recommend retaining custodians without ties to investment management firms or advisors.

Because this topic is very situation-dependent, we offer just a brief comment on the management of foundational assets/concentrated investments. A directly-held operating company or a larger real estate portfolio will typically have its own dedicated management team. If you have mostly sold your foundational, wealth-creating asset but still retain a residual stake, you may benefit from forward-looking advice on transaction planning and execution.

Administrative Services

Most principals (families or individuals) require some level of ongoing administrative support. These activities often include basic things like bookkeeping, bill-paying and executive assistance. As family members often prioritize freeing up time from tasks like these, this is an area where we see them looking for help early on.

As always, there is a wide range of approaches to procuring these Administrative Services. At the outsourced end of the spectrum, you can simply engage an accounting firm (or an accountant). However, we see that the first direct hire most families make is often a person to help them with administrative matters. This may be a personal assistant and/or a bookkeeper. As F.O.s grow, this team may expand with individuals in more specialized roles in line with activities that are areas of emphasis for the family. However, we caution that even these first steps should involve some consideration of confidentiality, information security, and redundancy.

Family Services

While there are some important commonalities among the first three categories of activities and services, Family Services in particular can and should vary dramatically across families. In this realm above all, the resources you require and assemble should reflect your priorities, preferences and personality. If owning extensive amounts of personal property is important to you, the need for property management services may be significant enough that you employ a dedicated in-house person or team. The same reasoning applies to travel and related concierge services. On the other hand, if these needs are relatively insignificant, you will have little need for dedicated resources.

Rounding out the Family Professional Services category, the amount of assistance you need to pursue charitable activities can also vary dramatically depending on the capital and time you commit and your engagement with these interests. We often see individuals and families take this on themselves with no outside support when their giving is simple (and often local) or where they have a deep personal interest (and want to spend their time). At the other end of the spectrum, establishing an active foundation with the funding to last many years can require dedicated staff. In between, we see the use of third-party providers like donor-advised funds and services to evaluate and recommend charities.

Coordination is Key – the “Hub”

Our clients range from virtual family offices (with no direct hires) to those with substantial in-house staff – and almost everything in between. A range of approaches will work if they fit the principals’ particular circumstances and needs. But, as we observed in our last publication, harmony and coordination are essential ingredients for a well-functioning solution. Because various expert professionals naturally tend to stay in their lanes, each family office (of whatever form) needs leadership with an overarching view of what you are trying to accomplish to provide direction to the various professionals. Their specialized work and expertise must be coordinated and their (sometimes disparate) advice harmonized to deliver the best solutions for the family principals.

At BCA, we often describe this activity as a “hub” connecting the various experts at the end of the many “spokes.” How best to provide this hub function depends on the family office resources you have put in place. In the case of virtual F.O.s (i.e. without permanent staff), your wealth advisors should be capable of playing an important part in the hub role. They should have skills to analyze problems, communicate with and coordinate a team and deliver solutions. In this capacity, your wealth advisors should be working alongside you as principal. You will choose how to share this hub role, but the answer should depend on your management style, skills and ultimately how involved you like to be. Regardless, your wealth advisor should adopt a perspective of “standing in your shoes” and putting your interests first. Importantly, your wealth advisory firm’s business model and culture will weigh heavily on its ability and willingness to do so.

Our mission is to deliver Unconditional Advice of which holistic, multi-disciplinary solutions are central. Therefore, Bitterroot Capital Advisors often (but not always), serves in that coordinating hub role. For clients with virtual family offices, we work alongside the principals. Our clients’ leadership style and desire for involvement determine how this collaboration works. The resulting “hub” solution should reflect whether you prefer to set priorities and policies and then let the team execute the plan, or organize and direct the team yourself.

Where the Family Office has dedicated staff, the hub role may be filled by a F.O. professional or externally. The operations are similar – when internal staff have sophisticated planning and coordination skills, we often serve alongside these professionals in the hub role or as expert contributors. Once again, depending on the family principals’ wishes, this collaboration may also include them directly.

Needs & Services

It is helpful to group frequently needed activities and services into four areas:

General Professional Services

Estate planning, entity structuring/governance, tax planning, tax preparation

Investment-Related Activities

Goal-setting, planning and strategic asset allocation, investment selection/ monitoring/reporting, direct investing and business support

Administrative Services

Accounting/bookkeeping, financial reporting, custodial accounts/treasury and bill-paying

Family Services

Residence/transportation management, concierge services, gifting/philanthropy/foundation

We think of the Family Office as the group of people working together to meet these needs. This can include professionals working at various firms engaged by the principals, people employed directly by the principals, or any mix of the two.

Infrastructure: Various Approaches are Possible

Your family’s level of wealth is crucial when weighing benefits and costs to determine the most effective approach to developing a F.O. solution. This influences types of needs that may be relevant and whether those needs are best met by internal or external resources. As mentioned, by “external” we mean engaging a third-party firm/professional on an outsourced basis (ongoing or project-based), and by “internal” we mean a direct “inhouse” hire (in a full or part-time role). Externally provided resources tend to be variable costs, while the cost of internal resources are often fixed.

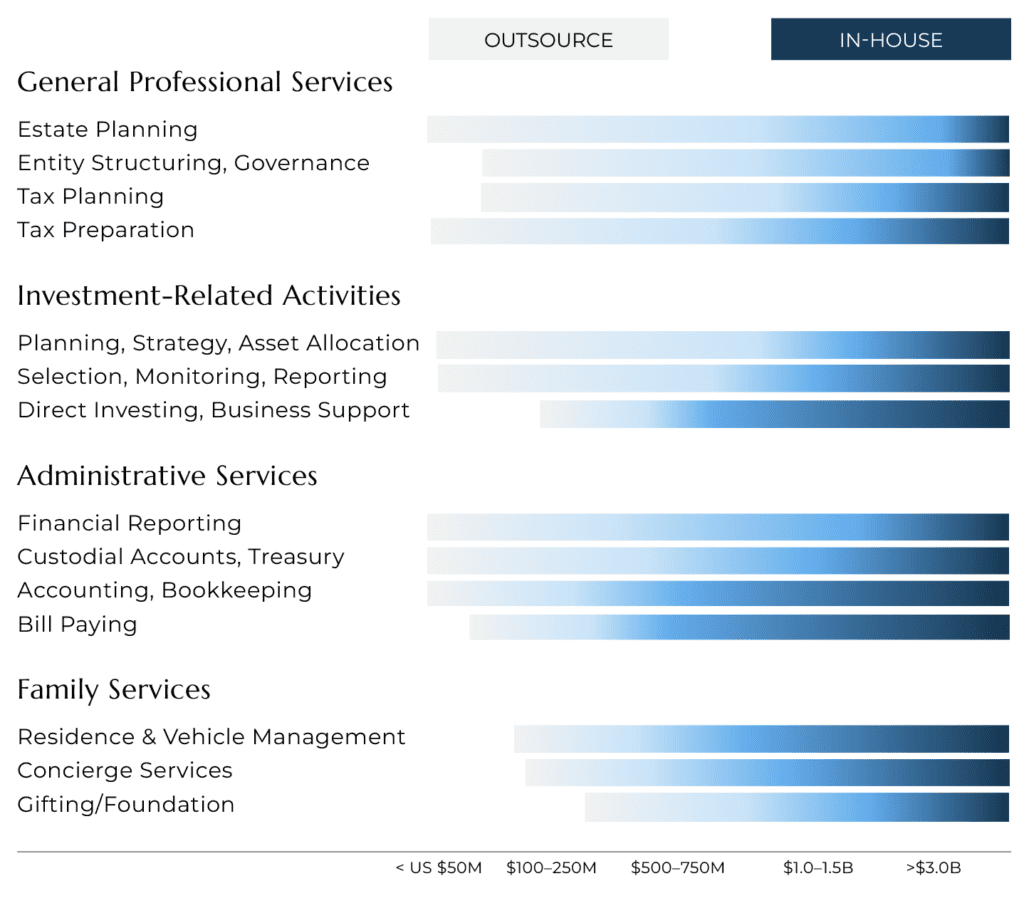

In our experience, the graphic on the next page represents general levels of wealth at which these various activities may become relevant and whether they may be best served by external or internal resources – or a mix of the two.

Evolution of Family Office Capabilities

General Professional Services

Fortunately, the activities that are more one-time or episodic are also those that require the most specialized expertise. As a result, in the General Services category, engaging third-party expert professionals is usually the most effective route for almost any level of wealth.

Such expert professionals include (but are not limited to):

- Trust & estate attorneys

- Tax attorneys

- Tax accountants and preparers

The frequency, complexity, specialization and responsiveness required (such as tax advice for cross-border investments or estate planning) may influence your decision on specific arrangements to engage the services of these professionals.

If you decide to use trust structures as part of your plan, there are many choices of trust types and related roles to be filled. These may range from using corporate trustees for more traditional services to individual trustees for what are sometimes more bespoke private trusts where more boutique trust companies provide administrative services.

Investment-Related Activities

The design and oversight of investment portfolios is a core need of family offices (and one of BCA’s core competencies). Investment design, strategy, oversight and implementation should be a broad-scope and dynamic activity to:

Define investment goals and policies to reflect your personal objectives

Allocate assets (i.e., what types and in what proportion), considering capital available and evolving market conditions

Execute the plan

Identify, evaluate, select and monitor a diversified collection of investment managers. We believe the management of specific investment strategies should be outsourced to specialty portfolio managers (both active and passive), each of which focuses on its particular expertise. The F.O. should have a comprehensive top-down plan to guide and evaluate this essential activity.

Report

Providing an integrated picture of exposures and performance of the entire, holistic portfolio, regardless of the source or management responsibility for each investment.

Only the very largest family offices – with more than $2 billion or so of investible assets in our estimation – may have sufficient scale to consider hiring an internal team of portfolio managers and related staff to both shape asset allocation and directly invest a significant portion of capital (and even then, should outsource many specialized investment strategies).

So principals are most often best served by using an investment advisor to design, execute and oversee a strategy using third-party managers. In our view, they should engage investment advisory services from independent firms without any commercial ties to portfolio managers (or their parent companies) or distributors selling those products. This separation creates inherent checks-and-balances and the best economic alignment between you and your advisor (while avoiding an advisor that is both referee and player).

Custodial relationships round out the investment infrastructure needs. They provide the vital functions of holding assets, executing trades and transferring funds. Our clients typically receive such services simply by opening accounts at bank subsidiaries and independent brokerage firms. For reasons like those discussed above, we generally recommend retaining custodians without ties to investment management firms or advisors.

Because this topic is very situation-dependent, we offer just a brief comment on the management of foundational assets/concentrated investments. A directly-held operating company or a larger real estate portfolio will typically have its own dedicated management team. If you have mostly sold your foundational, wealth-creating asset but still retain a residual stake, you may benefit from forward-looking advice on transaction planning and execution.

Administrative Services

Most principals (families or individuals) require some level of ongoing administrative support. These activities often include basic things like bookkeeping, bill-paying and executive assistance. As family members often prioritize freeing up time from tasks like these, this is an area where we see them looking for help early on.

As always, there is a wide range of approaches to procuring these Administrative Services. At the outsourced end of the spectrum, you can simply engage an accounting firm (or an accountant). However, we see that the first direct hire most families make is often a person to help them with administrative matters. This may be a personal assistant and/or a bookkeeper. As F.O.s grow, this team may expand with individuals in more specialized roles in line with activities that are areas of emphasis for the family. However, we caution that even these first steps should involve some consideration of confidentiality, information security, and redundancy.

Family Services

While there are some important commonalities among the first three categories of activities and services, Family Services in particular can and should vary dramatically across families. In this realm above all, the resources you require and assemble should reflect your priorities, preferences and personality. If owning extensive amounts of personal property is important to you, the need for property management services may be significant enough that you employ a dedicated in-house person or team. The same reasoning applies to travel and related concierge services. On the other hand, if these needs are relatively insignificant, you will have little need for dedicated resources.

Rounding out the Family Professional Services category, the amount of assistance you need to pursue charitable activities can also vary dramatically depending on the capital and time you commit and your engagement with these interests. We often see individuals and families take this on themselves with no outside support when their giving is simple (and often local) or where they have a deep personal interest (and want to spend their time). At the other end of the spectrum, establishing an active foundation with the funding to last many years can require dedicated staff. In between, we see the use of third-party providers like donor-advised funds and services to evaluate and recommend charities.

Coordination is Key – the “Hub”

Our clients range from virtual family offices (with no direct hires) to those with substantial in-house staff – and almost everything in between. A range of approaches will work if they fit the principals’ particular circumstances and needs. But, as we observed in our last publication, harmony and coordination are essential ingredients for a well-functioning solution. Because various expert professionals naturally tend to stay in their lanes, each family office (of whatever form) needs leadership with an overarching view of what you are trying to accomplish to provide direction to the various professionals. Their specialized work and expertise must be coordinated and their (sometimes disparate) advice harmonized to deliver the best solutions for the family principals.

At BCA, we often describe this activity as a “hub” connecting the various experts at the end of the many “spokes.” How best to provide this hub function depends on the family office resources you have put in place. In the case of virtual F.O.s (i.e. without permanent staff), your wealth advisors should be capable of playing an important part in the hub role. They should have skills to analyze problems, communicate with and coordinate a team and deliver solutions. In this capacity, your wealth advisors should be working alongside you as principal. You will choose how to share this hub role, but the answer should depend on your management style, skills and ultimately how involved you like to be. Regardless, your wealth advisor should adopt a perspective of “standing in your shoes” and putting your interests first. Importantly, your wealth advisory firm’s business model and culture will weigh heavily on its ability and willingness to do so.

Our mission is to deliver Unconditional Advice of which holistic, multi-disciplinary solutions are central. Therefore, Bitterroot Capital Advisors often (but not always), serves in that coordinating hub role. For clients with virtual family offices, we work alongside the principals. Our clients’ leadership style and desire for involvement determine how this collaboration works. The resulting “hub” solution should reflect whether you prefer to set priorities and policies and then let the team execute the plan, or organize and direct the team yourself.

Where the Family Office has dedicated staff, the hub role may be filled by a F.O. professional or externally. The operations are similar – when internal staff have sophisticated planning and coordination skills, we often serve alongside these professionals in the hub role or as expert contributors. Once again, depending on the family principals’ wishes, this collaboration may also include them directly.